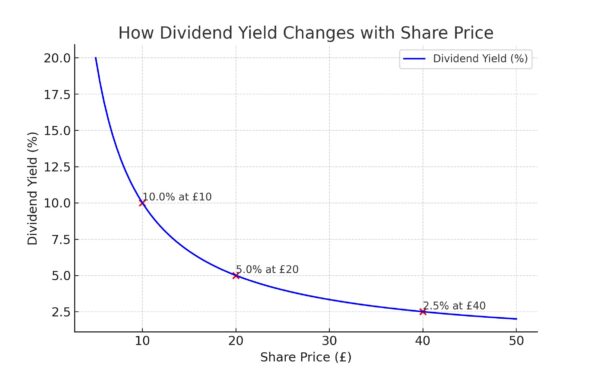

When looking at dividend stocks, it’s common to see two things: a high yield and a falling price (or vice versa). This is because the yield is the dividend’s percentage of the price, so it drops as the price rises.

Imagine a company that pays a dividend of £1. The below graph shows how the yield reduces as the price increases.

Therefore, it’s rare to find a soaring stock that still has a high yield. If so, it was either very high before, or the company recently raised dividends.

Should you invest £1,000 in Abrdn right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Abrdn made the list?

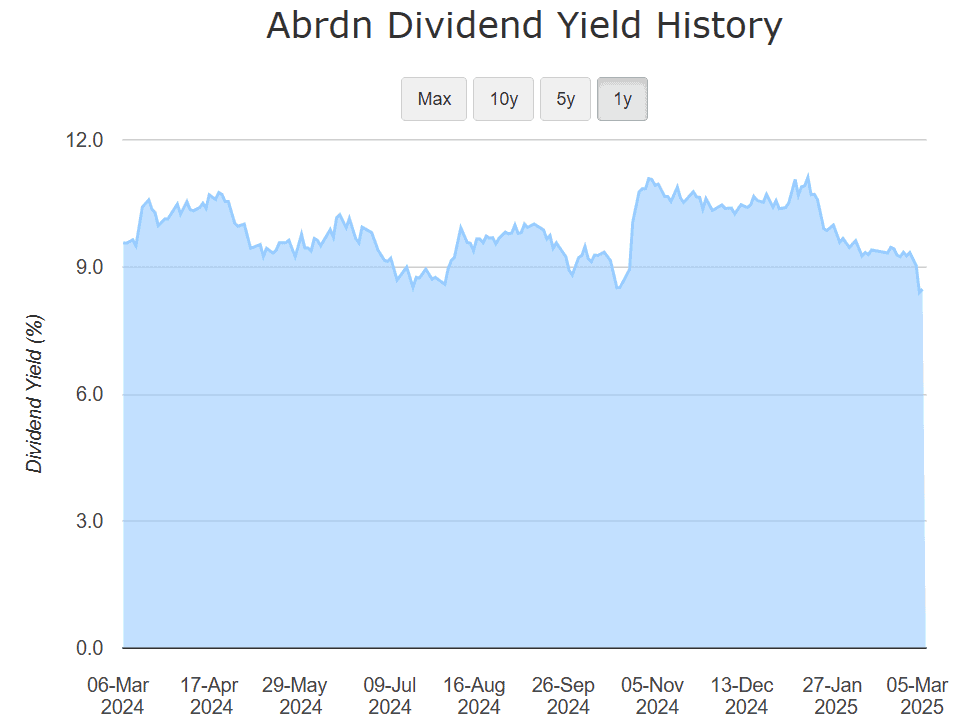

The latter is the case for investment firm aberdeen group (LSE: ABDN), formerly abrdn, before which it was Standard Life Aberdeen!

When the year began, its yield was sky-high at over 11%. But with the stock gaining 25% since the New Year, it’s dropped to 8.5%.

Still, that’s more than double the industry average, so I can’t help being tempted.

But what kicked off this recent rally – and does the investment have legs?

Let’s have a look.

A rose by any other name

The company released its 2024 results this week on Tuesday (4 March) with big news: vowels are back on the table!

That’s right, the much-maligned ‘abrdn’ moniker will be reverted to ‘aberdeen group’ (capital letters remain elusive).

The result was a resounding sigh of relief from investors and a subsequent 12% price jump. But the name was not the only good news.

Despite a 6% decline in adjusted operating income, it reported a 2% increase in operating profits to £255m. Assets under management (AUM) increased 3% and net capital generation was up 34%. Most notably, adjusted earnings per share (EPS) grew 8% and the final year dividend remained the same, at 14.6p per share.

The company has set ambitious targets to reach £300m in operating profits by 2026, but achieving these goals in a competitive market presents a significant challenge.

Following the impressive results, Deutsche Bank put in a Buy rating on the stock with a target of 200p.

Challenges remain

Despite the positive results, abrdn — sorry, aberdeen — remains one of the most shorted stocks on the FTSE 250.

The rebranding to aberdeen group has been positively received but still raises questions about the company’s strategic consistency. Yes, the previous rebrand was widely criticised but is reversal the answer? Could it not bring into doubt the board’s decision-making capabilities?

Frequent shifts like these suggest instability in leadership and strategy, which may affect investor confidence.

For a company that operates in a highly competitive and strictly regulated industry, it’s playing with fire. Whether this turnaround is enough to reignite long-term growth remains to be seen.

Looking ahead

With a dividend yield of 8.5% and a forward price-to-earnings (P/E) ratio of 10, the stock may offer a compelling opportunity for income investors to consider. Its customer base and AUM grew in 2024 despite the difficulties around the rebranding. That speaks volumes about its operations and business model.

However, the success of its turnaround strategy remains uncertain. If the company can sustain profitability and rebuild investor confidence, the shares could have further to run. Until then, I’ll keep an eye on it but won’t consider buying it just yet.